Global Manufacturing Mixed

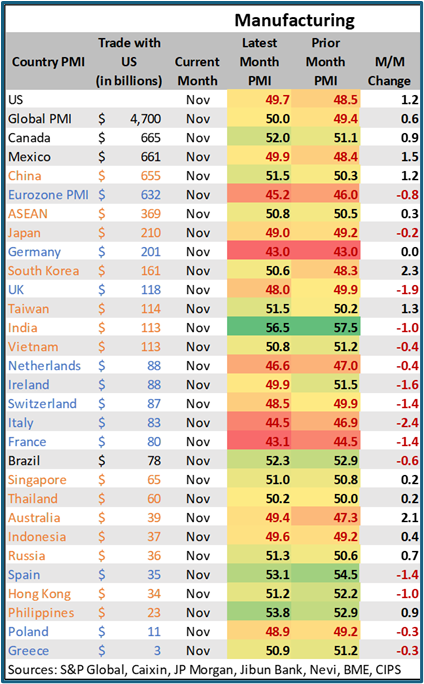

The latest manufacturing surveys from around the world paint a mixed picture of results based on the region of production, and perhaps some concerns about supply chain continuity in the month ahead.

USMCA markets (US, Mexico, and Canada) improved between October and November. The US and Mexico were still marginally in contraction with PMIs of 49.7 and 49.9 respectively. A reading below 50 is considered to be contracting, but it takes a reading of 46 or lower to signal real concern about a sector. Canada was strengthening quickly; the PMI came in with firm expansion at 52.0.

Asia was generally improving as well, and many countries cited the risk of tariffs and supply chain managers trying to get ahead of those risks as a reason for recent gains. Only Japan and Indonesia had markets in slight contraction.

Europe was a completely different story, most countries had manufacturing sectors in deep contraction. Germany, which is considered to be the manufacturing and economic anchor of Europe was in deep contraction, its PMI was the lowest in the world at 43.0. High energy and production prices have pushed global sourcing to alternative markets and general sluggishness in product purchases was keeping demand weak.

From a global supply chain perspective, the Red Sea situation was still keeping transportation prices higher. Container shipping prices between Asia and the US were 90% higher on average in early December and rates moving containers between Asia and Europe were 200% higher on average. In addition, concerns about a potential US East and Gulf Port strike starting on January 15th had many supply chain managers bracing for some further disruptions.

For most of 2025, the global supply chain should be entering a new economic cycle after two years of broad, general inventory overstocks. With inventories now back in-line, improved global manufacturing activity is expected overall.

Source: Various Global PMI Reports; S&P Global

Trump Administration Impact on Manufacturing

It is no secret that the Trump Administration is a big fan of US manufacturing. The incoming administration understands that the multiplier effect from manufacturing is one of the best ways of getting a strong economic return for every dollar of investment.

For instance, the Bureau of Economic Analysis estimates that $1 of spending in the manufacturing sector generates $1.48 in other services and production. In contrast, a $1 of spending in some of the social spending programs generates $1.03 in economic activity. Many of those social spending programs are critical in supporting society, but the Trump Administration understands that if it is given an opportunity to free up or invest more in a given sector, it will choose those areas that drive more economic activity for every dollar spent.

The incoming administration has signaled that it will also ease “red tape” and regulation to quickly promote growth and expansion of the US manufacturing sector. It has also signaled that it would use tariffs as a means to speed up the process (taxing firms that are importing from certain foreign markets). Although the incoming administration is currently touting blanket general tariffs of 25% on Canada and Mexico and 10% additional tariffs on Chinese products, in the first term the net effect of tariffs came in a more targeted manner. In the first Trump term, more than 55,000 tariff exclusion filings were processed by the USTR and 18,200 were initially granted. Ultimately, the full impact of tariffs and the motivation that it/may not provide in reshoring is still a question. But there is little question that tariffs will be a tool for the new administration, and firms need to prepare for the impact of those moves.