Construction Forecast for 2025 Optimistic

Several factors should give the construction sector optimism heading into 2025. It looks as though the Federal Reserve will strip another 100 basis points off of interest rates in 2025 on its way to a long-term terminal rate of 2.5-2.9%. This should help bring some projects off the sidelines and into process. In addition, continuation of funding under the final few years of the Infrastructure Act and some spending that is likely to continue under the CHIPS Act will continue to put new projects in the works. Even the Department of Government Efficiency (DOGE) will likely allow some projects not currently appropriated under the Inflation Reduction Act (IRA) to continue in some areas. However, the risk of budget cuts is likely higher on a broad base, possibly trimming some government-funding of construction projects (likely a bigger impact on 2026 and beyond).

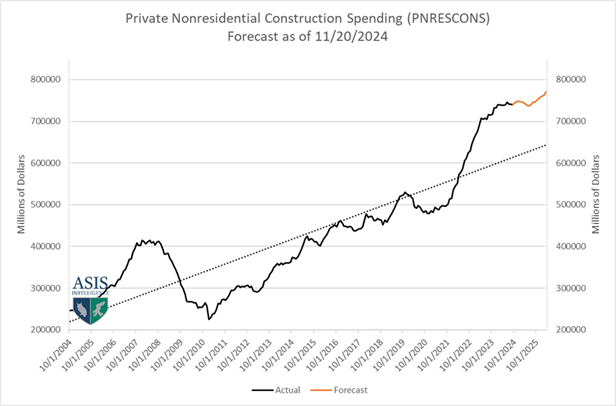

Construction spending estimates for 2025 remain optimistic and could likely get revised upward. Nonresidential construction spending was growing at a 3.9% rate at the end of October on more than $1.2 trillion in spending. This was heavily driven by the industrial construction sector, which was growing at 16.6% Y/Y on more than $236 billion in spending (when an average year is $60 billion).

The forecast for nonresidential spending shows that it will continue to trend above the 20-year average growth rate with total spending continuing at record levels (despite the percentage of change slowing against difficult comparisons from 2024).

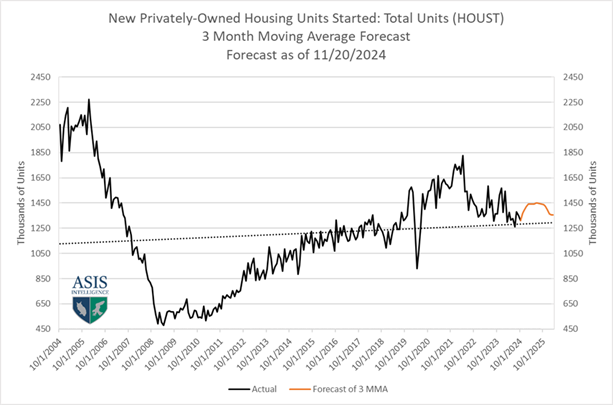

Residential construction activity is expected to be more volatile than its nonresidential counterpart. Residential construction spending was 6.4% higher year-over-year, being driven mostly by single-family activity. Single-family spending was up 1.3% on $423B in spending in 2024 while multi-family was down 6.8% in the wake of overbuilding in many regions of the country.

Despite this sluggishness, the outlook for residential construction shows some mild improvement early in 2025 followed by a flattening of activity (at this higher rate) until late 2025/early 2026. Most of the fueling of growth will come out of “the Great Wealth Transfer” (the transfer of funds from the baby Boomer Generation to younger generations), Federal Reserve easing of interest rates, some easing of construction material prices, and any softening of housing prices that might come as a result.

Again, there are still risks and the residential construction market in 2025 is expected to remain below average levels of spending over the past 4 years. However, total construction is still expected to hit levels that would have been higher than the peaks hit during the ten years between the Great Recession and Pandemic.

Keep in mind that regional differences are significant in the housing market. Some pockets of the country will remain robust with housing shortages and high demand while others cool or suffer from overbuilding.

Source: ASIS Reports; Construction Spending

Will Material Prices Ease in 2025?

There are a wide variety of materials used in all types of construction, and placing a broad statement on construction prices is risky. But the Census Bureau publishes a Producer Price Special Index that blends various construction material measures to create an aggregate index for all construction material prices.

In the latest data available from November, the index came in at 327 points (vs. the peak in May 2022 of 353), up 0.5% month-over-month and 0.1% higher year-over-year. Those inflation figures appear to be moderate, but the bigger story is the comparison to 2019. Construction material prices in aggregate are still 40.9% higher than they were prior to the pandemic.

Despite some slowing of global manufacturing activity and the subsequent drop in demand for raw materials that comes along with that trend, construction materials remain high. That certainly holds for certain components that are critical in projects but are currently in short supply or backordered. For instance, electrical control panels and commercial transformers are backordered for a year or more in some instances and prices for transformers hit an all-time high in November and were 3.4% higher year-over-year.

The volatility in prices will continue into 2025 based on most assessments. Higher transportation costs (largely as a result of the Red Sea and Suez Canal disruptions) will also continue to add significant costs to any imported products. Until the situation with Houthi Rebel attacks on commercial ships off the coast of Yemen can be rectified, this will continue to be an issue as ships are diverted into an additional 11 day transit around the Cape of Good Hope at the southern tip of Africa.

Source: Construction Materials PPI