Global Manufacturing Stalling Once Again

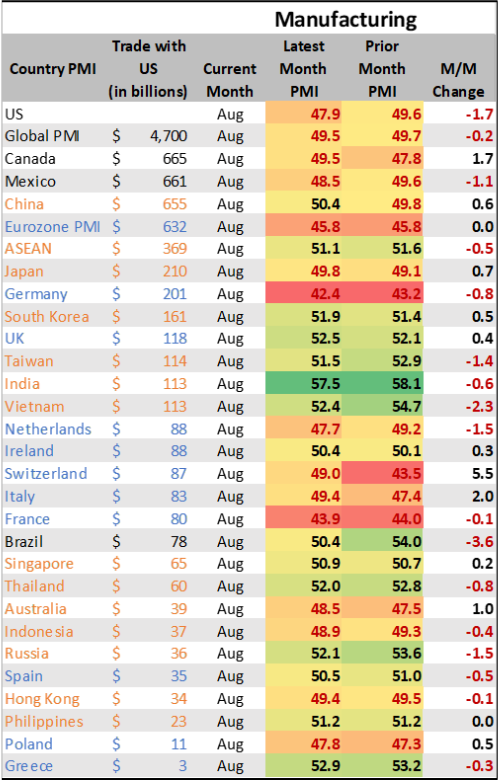

The latest manufacturing data from around the world showed that manufacturing was generally stalling and contracting headed into the peak retail season. The Global Purchasing Managers Index (PMI) showed that it fell to 49.5 from 49.7 and remained in mild contraction. USMCA markets were also contracting with the US at 47.9, Canada at 49.5, and Mexico at 48.5. Each country being under a reading of 50 signaled that it had manufacturing sectors in contraction.

Globally, new orders were generally weaker than expected, which will keep the outlook for manufacturing sluggish well into the fourth quarter. Hiring has generally paused, and some countries were going through some mild reductions in workforce. Inflation was slowly easing, but output prices (what manufacturers were able to charge for their products) were retreating faster than input costs. That is pressuring profit margins and is forcing manufacturers to make tougher decisions on inventory building activity, sourcing strategies, and other factors.

European markets were generally weaker than other markets, the Eurozone PMI was weak at 45.8. Europe is likely to face higher input cost pressure this winter as heating and general energy prices increase at a faster rate. That will put more pressure on Asian manufacturers that supply European firms. And both Asia and Europe reported in August that new orders from the US and USMCA markets were weaker than expected, slowing the entire supply chain from raw materials and intermediate products through finished goods and delivery to wholesalers or retailers.

Source: Various Global PMI Reports; S&P Global

Reshoring Activity Accelerates

Talk of a renaissance in manufacturing has bounced around for a decade or more. Ever since significant chunks of manufacturing were offshored in the wake of the Great Recession (as companies worked on trimming operating costs under weaker demand environments), analysts have expected some of it to come back to the United States.

A wave of events has reinforced the need to secure global supply chains. Starting with trade wars in 2016 and tariffs being imposed on certain industries (which have continued through the Biden Administration) to COVID, rising tensions in several regions, the global supply chain crisis in 2021/2022 and today’s inflation wave and the need to conserve cash and keep inventories lean have pushed more companies to build capacity in the US.

Through July, construction of new manufacturing facilities and expanding capacity grew at 20.1% year-over-year on more than $237 billion in annual spending. In a normal year prior to the pandemic, spending would have been just $50 billion. This wave of bringing new manufacturing capacity also extends well beyond just the CHIPS act and data centers. Many sectors are building capacity in the US to support local markets, and many foreign firms are opening localized facilities to stabilize their own global supply chains.

With tensions still higher than normal in the South China Sea, many global sourcing managers are still seeking diversification of supply chain risk. Moving manufacturing capacity into the USMCA markets (former NAFTA) makes sense.

.png?sfvrsn=c0695a37_1)