The Federal Reserve and New Construction Starts

Many industry watchers pay attention to the AIA/Deltek Architecture Billing Index (ABI) for a sneak peak into future construction activity. When architects begin design and planning work on a project, construction activity will typically flow within 2-4 months. The most recent ABI came in at 48.2 for July (against 46.4 last month) which was the latest available (a score of 50 represents a neutral market, under 50 suggests that billings are still slipping). Despite this deceleration in billings, it is probably the commentary that is most interesting.

Many architects are reporting that their conversations with clients are now accelerating, because of the anticipated trimming of interest rates by the Federal Reserve. The ABI includes a project inquiry index, and it inched up to 52.4 in July, indicating that there are more firms now inquiring about projects. Many clients that had put projects on hold have begun to dust off those plans and are going to update them for an early 2025 launch. Although 2025 may be slightly weaker overall than 2023 or 2024 activity, there will be enough activity that many construction firms are expected to have a solid financial year.

On a regional basis, the northeast had the strongest performance with a 50.0, followed by the Midwest (47.6), South (46.3) and West (46.0). Weather has not been a factor in many parts of the country, the southeast has had some flooding issues through much of the summer but delays are sporadic. Cleanup from the spring severe storm surge in the Midwest was still a modest factor, but most projects now are planned expansions, new facilities, and relocations.

Source: Armada Corporate Intelligence; AIA

Construction Spending in July Still Shows Strength - in Pockets

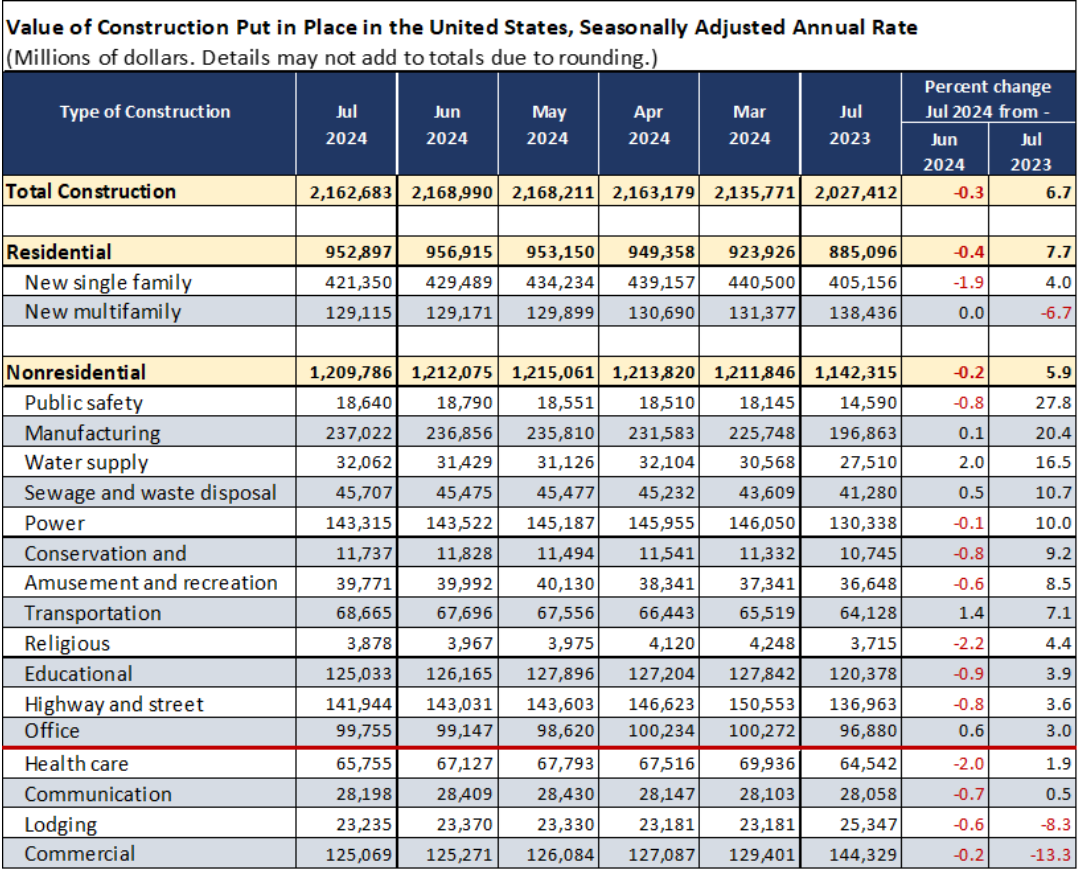

Construction activity in the US decelerated slightly between June and July, it fell by 0.3% but remained 6.7% higher year-over-year. Other signals in construction were also showing a modest amount of deceleration. Construction job openings were sharply lower by 29.3% in July vs. July of 2023 and were lower by 17.1% between June and July. In addition, new home starts were down by 6.8% month-over-month in July and were 16.0% lower year-over-year.

Residential construction was still 7.7% higher year-over-year. Single-family spending was still year-over-year, but the more volatile multi-family category was down 6.7%. Many regions of the country experienced some mild overbuilding of multi-family facilities over the past year, and many firms are taking a “breather” before taking on the next wave of projects. Many will wait for the Federal Reserve to trim interest rates before proceeding with more speculative project work.

Nonresidential is now cyclically divided into two primary categories. Sectors that are being impacted by Government spending under the CHIPS Act, Inflation Reduction Act, and Infrastructure Bill are still showing strong growth. Government funding in these programs will continue to contribute significantly to growth over the next two to four years.

Investments in manufacturing construction are also still growing at 20% Y/Y and more importantly, at $237B in annual spending, this is nearly 4 times more than an average year in the decade prior to the pandemic.

The rest of the nonresidential categories are stalling, and at least four sectors are contracting after adjusting for inflation (those sectors under the red line in the accompanying table).

Interest rate cuts by the Federal Reserve can bring many projects off of the sidelines and create some activity in the medium term. Consecutive rate cuts will also fuel further growth later in 2025 and 2026.

Source: US Census Bureau

.png?sfvrsn=7ea31013_1)