While bonuses may seem like an easy way to incentivize or reward employees, employers should consider a few factors to ensure proper payroll reporting and payments to their employees. These factors include recognition of the bonus type, identification of whether they are discretionary or non-discretionary, and calculation of overtime for non-exempt employees.

Discretionary or Non-Discretionary

Discretionary bonuses are those where no plan or promise is in place for the bonus. These bonuses are not expected by an employee on a regular basis. The bonuses and the amounts given are not based on performance of the employee and cannot be influenced by the employee. Discretionary bonuses include holiday bonuses, employee gifts, employee of the month bonuses, and bonuses paid out due to the company’s success.

Non-discretionary bonuses are those where there is a plan in place for the bonus. These bonuses are most likely in writing as part of the employee’s compensation or have been discussed ahead of time with the employee as to how to achieve the bonus and how it will be calculated. Non-discretionary bonuses include sales commissions and established goal or metric-based bonuses.

Referral bonuses can be either discretionary or non-discretionary, depending on the context. They generally fall into the discretionary category, provided that employee participation is voluntary, the employee’s recruitment efforts do not involve significant time, and the activity is limited to after-hours solicitation done among friends, relatives, neighbors, and acquaintances as part of the employee’s social affairs. Non-discretionary referral bonuses apply to employees primarily engaged in recruiting activities.

Calculations

If the employer determines the bonus being paid to the employee is discretionary, the employer should exclude it from the non-exempt employee’s regular rate of pay when calculating overtime to be paid. However, if the employer determines the bonus is non-discretionary, the employer has two options for calculating overtime for the non-exempt employee, both of which should result in the same amount of total gross pay.

Non-discretionary option one adds the bonus to the regular rate of pay to calculate a revised rate for overtime. The total (regular rate of pay + bonus) is divided by the total hours worked during the weekly period to arrive at a new hourly rate. The revised rate should be multiplied by 0.5 to compute the premium overtime rate. Multiply the premium overtime rate by the number of hours over 40 and add this sum to the total compensation to arrive at the total due to the employee.

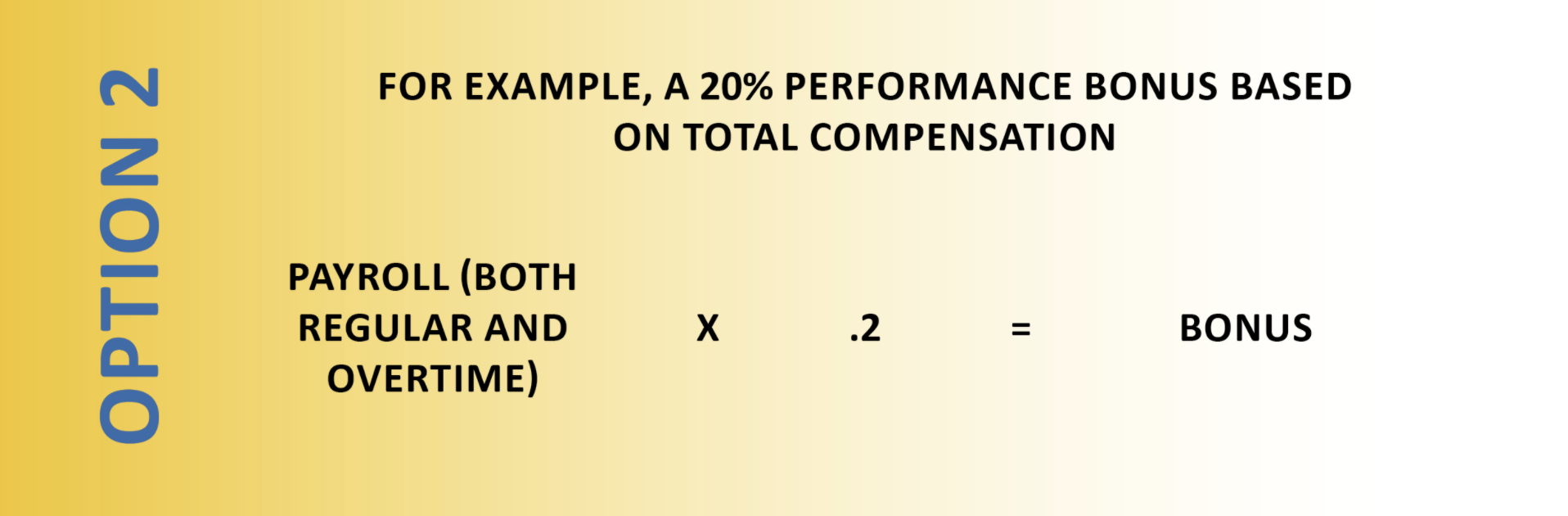

Non-discretionary option two requires the bonus to be based on total compensation, which includes overtime. For example, a 20% performance bonus based on total compensation. Payroll would be calculated, including both regular and overtime, and then multiplied by 20% to calculate the bonus.

PPP Considerations

Bonuses, whether discretionary or non-discretionary, are included in the definition of compensation for the purpose of the Paycheck Protection Program qualified payroll costs. Total compensation, which includes any bonus payments, for an employee cannot exceed $100,000 on an annualized basis.

If you have any questions regarding bonuses and non-exempt employee overtime calculations, please reach out to your MarksNelson team and we would be happy to assist you.