In 2018, the US Supreme Court issued a landmark ruling that overturned sales tax precedent held for more than two decades. In South Dakota v. Wayfair, the Courts determined physical presence was no longer a requirement for states to impose their sales tax filing responsibilities on nonresident businesses.

Some argue that because Wayfair dealt with sales tax law, income tax laws were unaffected by the ruling. But is this true?

The short answer is yes, Wayfair had no direct impact on how states tax business income. But the long answer is more nuanced.

What Did Wayfair Do?

On its own, South Dakota v. Wayfair changed no tax laws; it simply opened the door for states to change theirs. Following the Wayfair ruling, states began passing tax laws that imposed filing responsibilities on out-of-state businesses, even those that had no physical connection with the state. Most of these tax laws centered around a concept known as economic nexus.

States that have an economic nexus doctrine can impose tax laws on an out-of-state business if the business is merely economically connected with the state. The economic connection test varies, but for many states, businesses will establish economic nexus for sales tax if they make at least $100,000 of sales into the state or complete at least 200 separate transactions into the state. Today, most jurisdictions have either passed an economic nexus law for sales tax or are actively working to get one passed.

On its surface, these movements have nothing to do with income taxes. But if you dig a bit deeper, you can see how Wayfair and the country’s subsequent focus on economic connections has influenced state income tax law.

How Did Wayfair Affect Income Tax Nexus?

Following the Wayfair ruling, states felt more confident exploring economic nexus for income tax purposes. Since the ruling in 2018, a handful of states have passed tax laws that define economic nexus for income tax, including the following:

- Beginning in 2020, Texas began taxing businesses if $500,000 or more of their gross receipts were sourced to Texas.

- For tax years beginning in 2023 or later, a business will have income tax nexus in Pennsylvania if they have $500,000 or more Pennsylvania-sourced receipts.

- Starting in 2020, Washington began subjecting remote businesses to their Business and Occupation Tax if they had more than $100,000 of gross receipts sourced to Washington.

Knowing that the US Supreme Court considered economic connections to be noteworthy, Wayfair gave states the courage to establish new economic nexus standards for income tax.

How Did Wayfair Affect Apportionment Methods?

Wayfair also influenced how multistate businesses apportion their income.

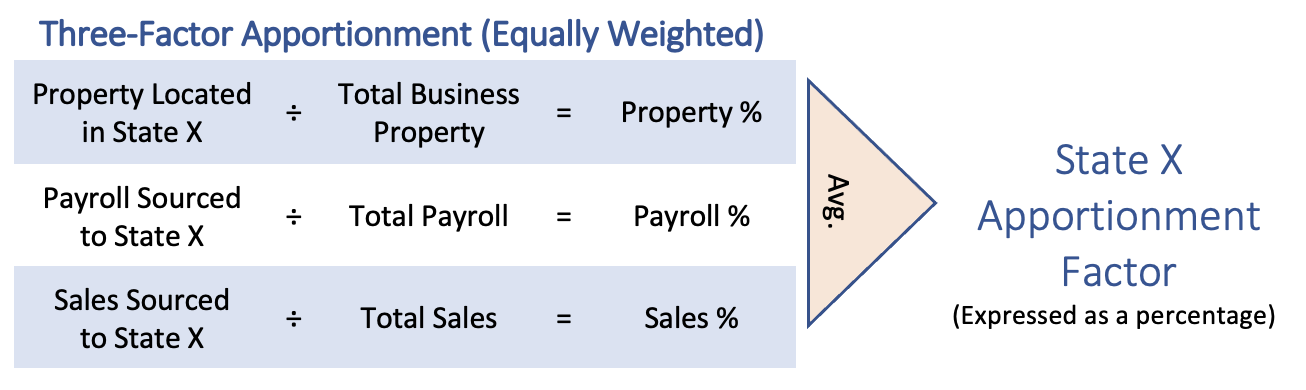

To ensure they don’t pay tax on the same income in more than one jurisdiction, multistate businesses apportion their income among the states in which they have nexus. Historically, most states used a three-factor apportionment method to tax multistate businesses. This three-factor formula took two physical characteristics — property and payroll — and one economic characteristic — sales — into account.

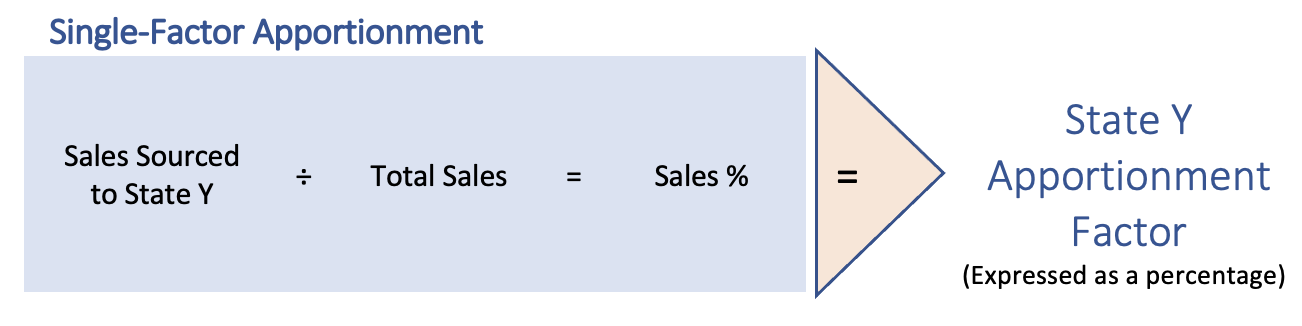

Three-factor apportionment methods are slowly being replaced by single-factor methods. In single-factor apportionment, states apportion income based solely on how much of a business’s total sales are located within their state.

By apportioning income based on sales, an economic characteristic, a state could capture more of a remote business’s income even if the business had no property or employees (i.e., physical presence) in the state.

The trend toward single-factor apportionment began before Wayfair, but some believe that the Supreme Court’s acknowledgement of economic presence for sales tax purposes has helped states embrace sales-only apportionment factors.

Market-Based Sourcing Post-Wayfair

When businesses begin their apportionment calculation, they need to know how to source their sales. They must answer the question, “Which states do these sales belong to?” The answer is fairly straightforward when sourcing sales of tangible personal property, but it’s less clear when sourcing sales of services or intangibles. There are two main methods for sourcing sales revenue for nontangible property: cost of performance (COP), and market-based sourcing.

In COP sourcing, sales of intangible items are sourced to where the income-producing activity was performed. For many businesses, this is at their physical headquarters. Market-based sourcing, on the other hand, sources income to where the product or service is used. Usually, this is the purchaser’s home state.

Market-based sourcing embraces the concept of economic presence. It allows states to claim sales from remote businesses that have no physical connection with their state. Since Wayfair, we have seen some states (including Indiana, New Mexico, and Vermont) replace their COP sourcing methods with market-based sourcing models.

Income Tax Nexus in and Around Missouri

If your Missouri-based business operates in one or more of the surrounding states, you should pay close attention to how your business income is being taxed. Do your customers live in states outside of Missouri? If so, do you have nexus with that state? And if you do have nexus, do you know how to source your sales and apportion your income? Below is a chart that answers some of these nexus questions you may have.

State | Economic Nexus Doctrine for Income Tax | Apportionment Method | Sales Sourcing Method |

| Kansas |

“Corporate income tax is assessed against every corporation doing business in Kansas or deriving income from sources within Kansas.”

| Equally Weighted Three-Factor Formula | Cost of Performance Sourcing |

| Nebraska |

“Nebraska imposes a corporate income tax on all corporations that earn any part of their federal taxable income from Nebraska sources.”

| Single Sales Factor | Market-Based Sourcing |

| Illinois |

“Sales… are in this State if the purchaser is in

| Single Sales Factor | Market-Based Sourcing |

| Arkansas |

“Every corporation organized or registered under the laws of this State, or having income from Arkansas sources… must file an income tax return.” | Single Sales Factor for tax years beginning on or after January 1, 2021 | Cost of Performance Sourcing |

What's Next?

There’s no doubt that economic nexus principles are on the rise, and we expect this trend to continue in the coming months and years. If you want to discuss economic nexus and income tax, reach out to us today.